salt tax deduction new york

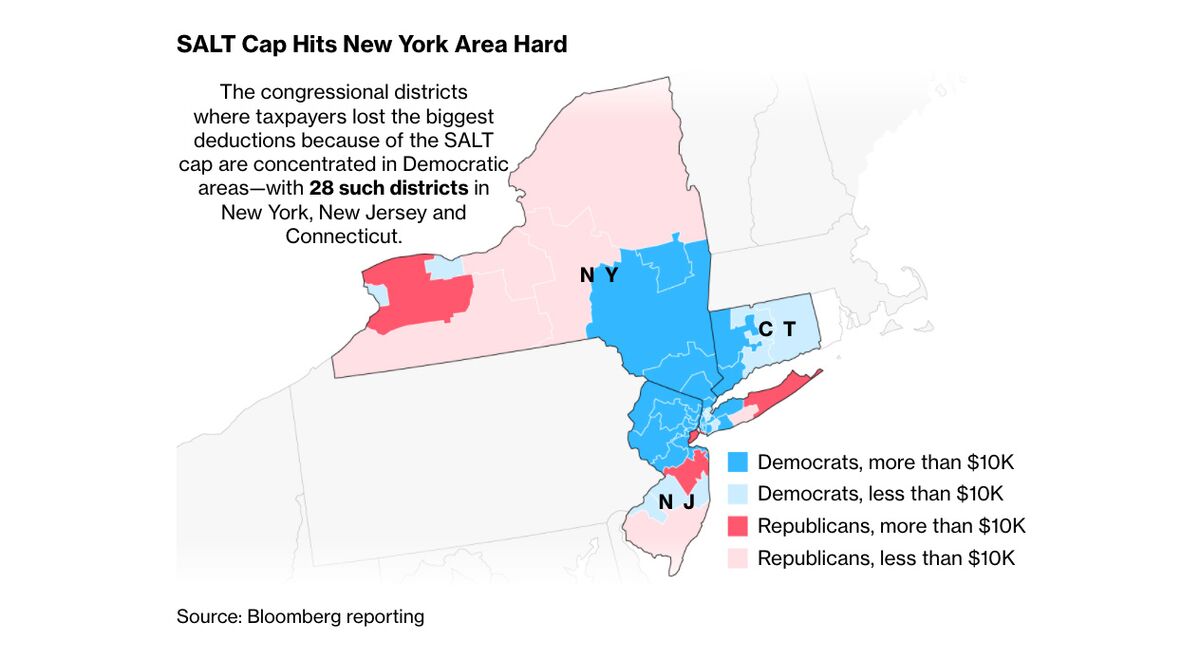

Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to. The SALT cap limits a persons deduction to 10000 for tax years beginning after December 31 2017 and before January 1 2026.

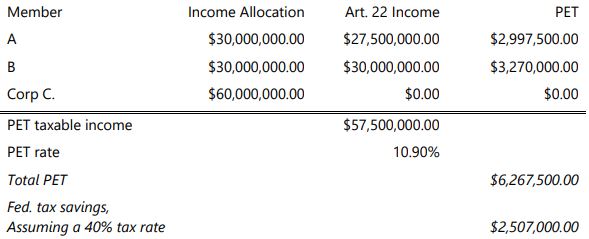

The pass-through entity tax represents a welcome tax planning opportunity for New York State individual taxpayers given that these taxpayers were traditionally among those with the highest average federal deductions for state and local taxes before the implementation of the SALT limitation.

. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

April 11 2021 700 pm ET. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

The SALT deduction is only available if you itemize your deductions using Schedule A. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property.

In 2018 Maryland was the top state at 25 percent of AGI. Tom Suozzi has taken a leading role in fighting to restore a tax deduction that. New York enacts pass-through entity tax election as SALT deduction workaround.

This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household.

Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. For example the average SALT deduction claimed in New York was 23804 in 2017 and 5451 in Alaska in the same year according to Internal Revenue Service data. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

The decline from 2016 to 2018 was driven by the SALT deduction cap and to a lesser extent the drop in itemization due to the doubling of the standard deduction. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that. Many states have recently enacted SALT cap workarounds to protect. The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. This provision is not available for publicly traded partnerships.

The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. In tax years 2018 to 2025. October 1 2021 Article 1 min read.

New Yorks pass-through entity tax will allow certain partnerships and New York S corporations an annual election to pay income tax on behalf of its owners. The Pass-Through Entity tax allows an eligible entity to pay New York State tax. The election must be made by October 15 for tax year 2021.

New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. New Yorks SALT Workaround. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions.

This new legislation is better late than never since.

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction Cap Stays In Place After Supreme Court Rejects New York Challenge Thinkadvisor

It S Personal Planning For New York S Pass Through Entity Tax Lexology

Salt Deduction Limit Avoiding The 10 000 Federal Limitation In New York

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Cuomo Privately Calls On Business Leaders To Stay In Ny Lobby On Salt

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Leaving New York To Get Tax Relief Prepare To Be Audited

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

Budget For Family Of Three Retiring Early Off 5 Million Early Retirement 10 Million Dollars Retirement

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation